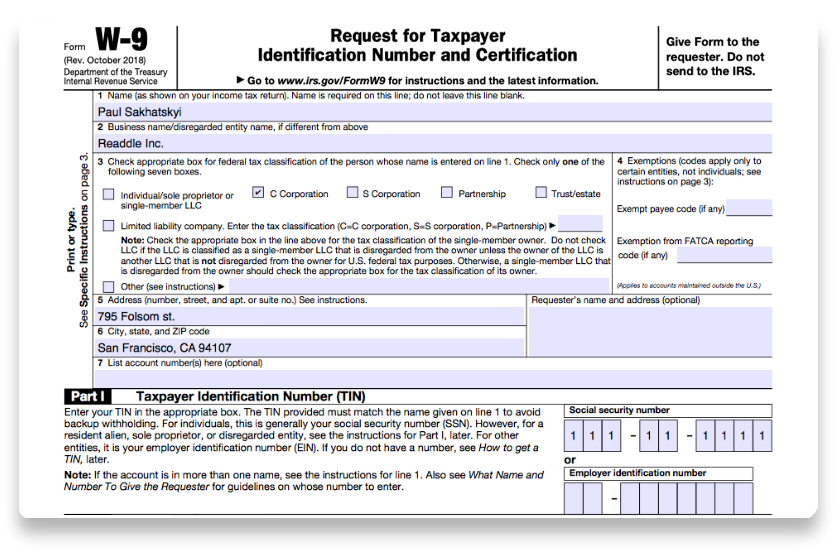

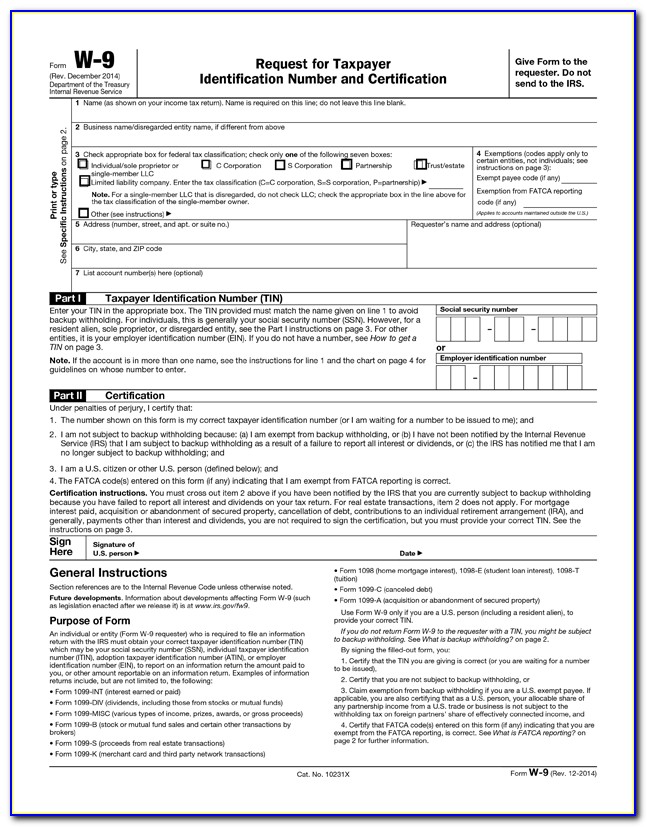

In the first example, John must use a W-9 form to properly report his income and expenses, while in the second case, Sarah must file a W-9 form to give information about her financial need and academic background. In both of these examples, the individuals are required to use a W-9 federal form in order to provide accurate and complete information about their circumstances. Employer Tax Withholding Forms BC-941 Monthly (Fillable PDF) BC-941 Quarterly (Fillable PDF) SS4 - Employers Withholding Registration (PDF) BC-W4 Employees. In order to be considered for financial aid, Sarah must complete a W-9 form that includes information about her academic background, financial need, and other relevant details. Sarah is currently enrolled in a four-year degree program at a local university, and she relies on financial aid to help pay for her tuition and other expenses.

There are many different situations in which individuals must use a form.

0 kommentar(er)

0 kommentar(er)